Hardcore Bitcoiners are understandably skeptical about Blockstream’s Liquid sidechain. But as the Bitcoin ecosystem grows, we’re going to need more services backed by Bitcoin that Bitcoin itself can’t provide. Liquid is a semi-centralized side chain that — crucially — has no unnecessary shitcoin. This blog series will discuss some of the use cases that are now possible through Specter Hardware and Specter Desktop’s integration with Liquid that might interest Bitcoiners the most.

HyperBitcoinization

In a hyperbitcoinized world, companies and projects will still need to raise capital and to issue shares and bonds. These equity, debt, and financial instruments will need to be managed in ownership registers. Voting processes, dividend and coupon payments will still need to be executed. Additional equity or debt will need to be issued to facilitate further build-out of projects.

This type of structure, operation, and governance can’t be done natively on Bitcoin. Nor should it.

The challenge is that many Bitcoiners suffer from significant post-traumatic stress syndrome due to years of scammy clowncoinery promising to securitize and tokenize everything on a blockchain. We instinctively want to throw our hands in the air and walk away from these conversations.

But there are financial innovations and efficiencies coming. We just can’t allow this new securities infrastructure to be built on a pile of premined, VC-controlled, decentralization theater BS. When bitcoin becomes the premier global store of value within the next decade, we must have the tools in place to raise capital on infrastructure that is firmly rooted in bitcoin.

Citadel Entry Fee: Bitcoin

Over the last few years the discussions around Bitcoin citadel infrastructure projects have developed nicely. Libertarian thinker and entrepreneur Titus Gebel wrote a seminal book about so-called Free Private Cities. It reads like a free open-source manual for citadels.

These advanced special economic zones will be based on a strong individual contract between the citizen and the service provider of said city. This is in stark contrast to the weak social contracts we have now which can be changed quite arbitrarily by the government administration — mostly with the result of decreased quality of service in combination with higher taxes and tighter regulation.

Recently a few projects have sprung up in Honduras, such as Prospera on Roatan Island, Guanaja Hills on Guanaja Island, or Morazan City on the mainland. Rumors are that there are a few other projects in other regions which are in advanced stages of development.

As the sovereign individual thesis continues to play out and our legacy governance systems crumble, these citadel infrastructure projects will prove to be interesting investment opportunities, especially in a late-stage hyperbitcoinization scenario. And they won’t be accepting fiat or any shitcoins. But on the flipside, once you’ve paid your bitcoin-only buy-in fee, how will your ownership stakes be managed? What does shareholder equity in a Bitcoin citadel look like?

Securities on Liquid

The optimal place to raise capital in a hyperbitcoinized world and to manage ownership rights will be on a sidechain that has a high degree of interoperability with the Bitcoin blockchain. When my bitcoin goes into an investment, I’ll want cryptographic assurances that my ownership rights are clear and enforceable. At the moment, the Liquid sidechain looks like a serious contender.

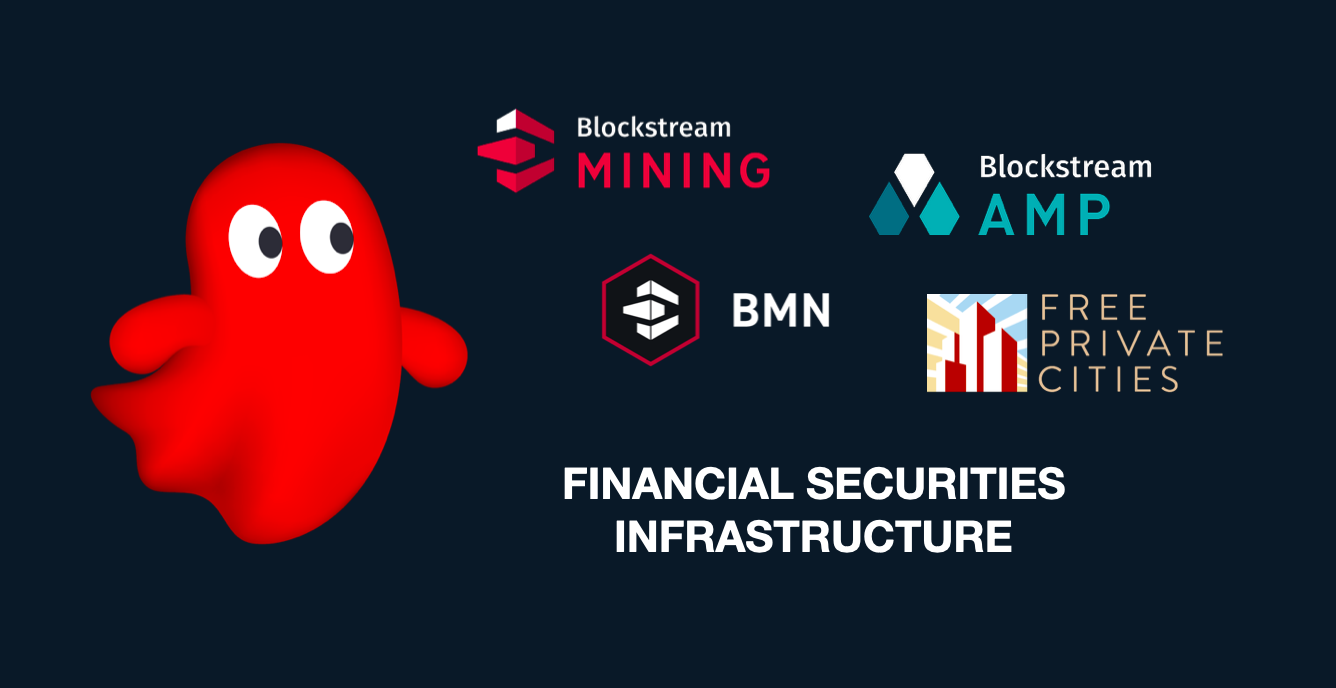

This is all fine in theory. But as I said above, we’ve heard all these promises before. But there is at least one really interesting real-world use case for a security offering on Liquid: The Blockstream Mining Note* (BMN).

* Not financial advice. Not an endorsement. Just some cool stuff we heard Adam Back talk about on a podcast.

Blockstream sells BMNs to fund new bitcoin mining operations. One BMN holds the rights to 2,000 terahash (TH/s) with the bitcoin mined to be paid out when the note reaches maturity after three years. It’s a bit hard to parse Adam Back’s tweet, but he’s pointing out some pretty promising ROI numbers (1.65 BTC earned with 90% of the three-year term still to go).

The notes are tradable securities on the Liquid sidechain and as each note steadily accrues more bitcoin value as it is mined and that yield can be priced in by the market. The notes can even be resold in smaller 0.1 BMN sizes. Whoever holds a BMN slice on its maturity date receives that share of the note’s accumulated bitcoin. Read that again: the note holder receives the mined bitcoin.

All of these assurances, ownership divisibility, and ownership transferability are managed on the Liquid sidechain. Right now. And coming soon in an upcoming Specter release, you’ll even be able to self-custody your BMN using your Specter Hardware wallet and Specter Desktop software.

To be fair, there are deeper BMN details that we have not seen for ourselves, so retain some skepticism and do your research. And to put things into perspective from an adoption point of view: Liquid currently stands where Lightning was in 2018. We’re super early. But stay tuned and keep an eye out for Liquid building out serious financial markets infrastructure.

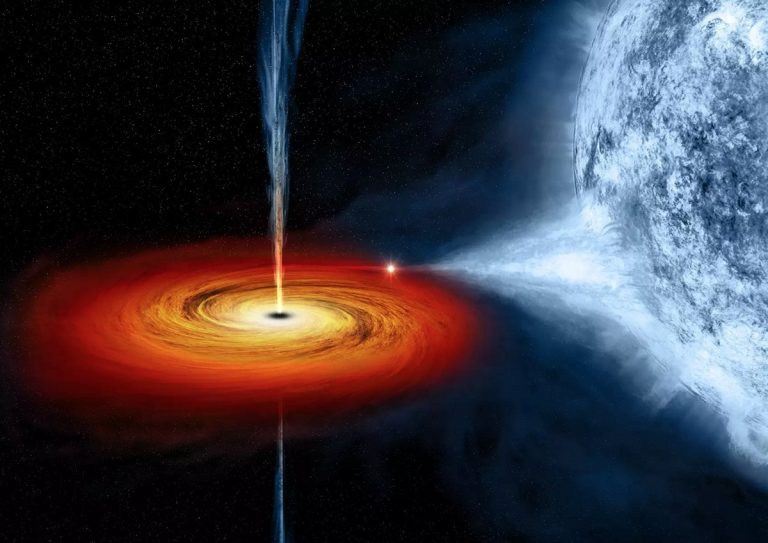

Bitcoin is sucking in monetary premiums like a black hole. Lightning is striking and challenges legacy payment rails. Liquid has an excellent chance to be the securities infrastructure running on the monetary singularity of Bitcoin.

How to get started:

- Update to the latest Specter Desktop release v1.7.0

- Run a local Elements “Liquid” node (current chain size: ~17GB).

- Create a hot wallet for Liquid in Specter Desktop.

- Or check out the Liquid supporting hardware wallets: Blockstream Jade or our Specter Hardware Wallet

- You can assemble a Specter HWW yourself with off the shelf-components (see shopping list) or buy pre-assembled kits at Seedsigner’s shop or the DIYnodes shop.